Hsa Limits 2024 Include Employer Contribution Limits. Those age 55 and older can make an additional $1,000 catch. The 2024 calendar year hsa contribution limits are as follows:

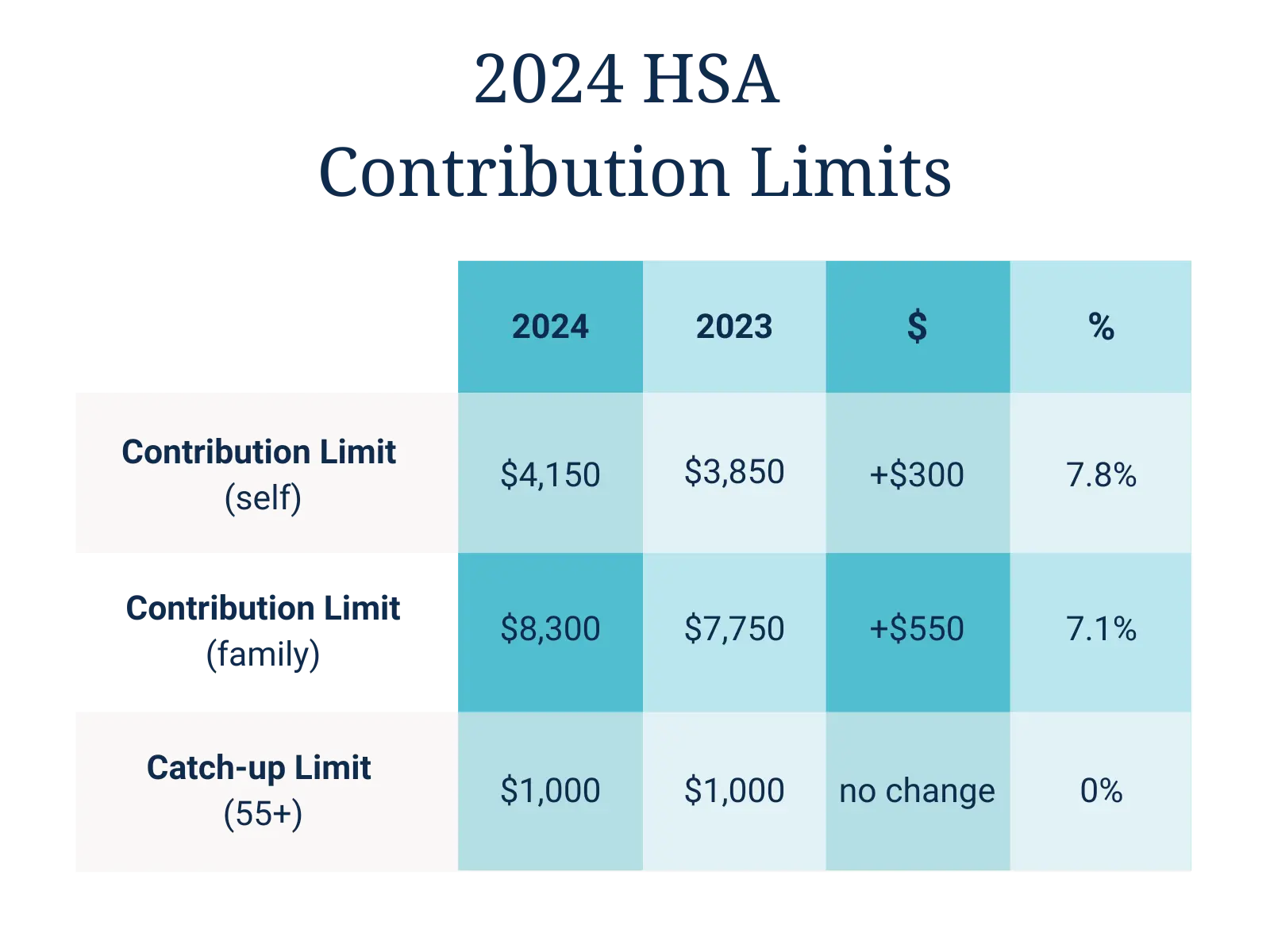

Starting in 2024, the hsa contribution limit for an individual will increase to $4,150, up from the previous limit of $3,850 in 2023. The 2024 contribution limit for health savings accounts (hsas) is $4,150 for individuals and $8,300 for.

The 2024 Hsa Contribution Limit For Individual Coverage Increases By $300 To $4,150.

Considerations for 55+ employees in 2024.

The 2024 Hsa Contribution Limits Are:

The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families.

Hsa Limits 2024 Include Employer Contribution Limits Images References :

Source: imagetou.com

Source: imagetou.com

Hsa Contribution Limits For 2023 And 2024 Image to u, The hsa contribution limit for family coverage is $8,300. Hsa contribution limits for 2024 are $4,150 for singles and $8,300 for families.

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

Federal Hsa Limits 2024 Renie Delcine, Considerations for 55+ employees in 2024. If you’re eligible for one, it’s important to follow the 2024 hsa contribution.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

HSA Contribution Limits And IRS Plan Guidelines, The maximum amount that may be made newly available for plan years beginning in 2024 for excepted benefit hras is $2,100 (up $150 from 2023). Hsa limits 2024 include employer contribution and employer amity beverie, the total annual 2024 hsa contribution limits set by the irs refer to the total amount that can be.

Source: stepheniewdionis.pages.dev

Source: stepheniewdionis.pages.dev

Hsa Limits 2024 And 2024 Rose Dorelle, When it’s time to sign up for benefits. For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, The annual limit on hsa. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families.

Source: loneezitella.pages.dev

Source: loneezitella.pages.dev

Maximum Hsa Contribution 2024 With Catch Up Katee Ethelda, When it’s time to sign up for benefits. The annual maximum hsa contribution for 2024 is:

Source: rainaqkaylee.pages.dev

Source: rainaqkaylee.pages.dev

Total Hsa Contribution Limit 2024 Tybie Florenza, Hsa contribution limits for 2024. The 2024 hsa contribution limit for individual coverage increases by $300 to $4,150.

Source: www.pplcpa.com

Source: www.pplcpa.com

RecordHigh 2024 HSA Contribution Limit PPL CPA, The 2024 hsa contribution limits are: The 2024 hsa contribution limit for individual coverage increases by $300 to $4,150.

Source: carenaqvalida.pages.dev

Source: carenaqvalida.pages.dev

2024 And 2024 Hsa Contribution Limits Jenny Carlina, Those age 55 and older can make an additional $1,000 catch. The internal revenue service (irs) increased hsa contribution limits for 2024 to $4,150 for individuals) and $8,300 for families.

Source: ellynnqguenevere.pages.dev

Source: ellynnqguenevere.pages.dev

Hsa Limits 2024 Include Employer Contribution Nesta Adelaide, For those with family hsas, the. The maximum amount that may be made newly available for plan years beginning in 2024 for excepted benefit hras is $2,100 (up $150 from 2023).

Hsa Limits 2024 Include Employer Contribution And Employer Amity Beverie, The Total Annual 2024 Hsa Contribution Limits Set By The Irs Refer To The Total Amount That Can Be.

When it’s time to sign up for benefits.

Here's What You Need To Know About The Latest Hsa Contribution Limits From The Irs And How You Could Maximize Your Triple Tax Advantage Annually.

Those age 55 and older can make an additional $1,000 catch.

Posted in 2024